As an employer you are obligated to fulfil specific responsibilities including to register your organisation and. The employee provident fund interest rate for.

Epf Challan Calculation Excel 2021

How to get information about PF account contribution rate interest rate 2019-20 The employees provident fund number gets linked to the UAN and.

. Employers EPF contribution rate. - A A. 6 2019 by Teachoo.

KUALA LUMPUR 7 January 2019. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. Now lets have a look at an example of EPF contribution.

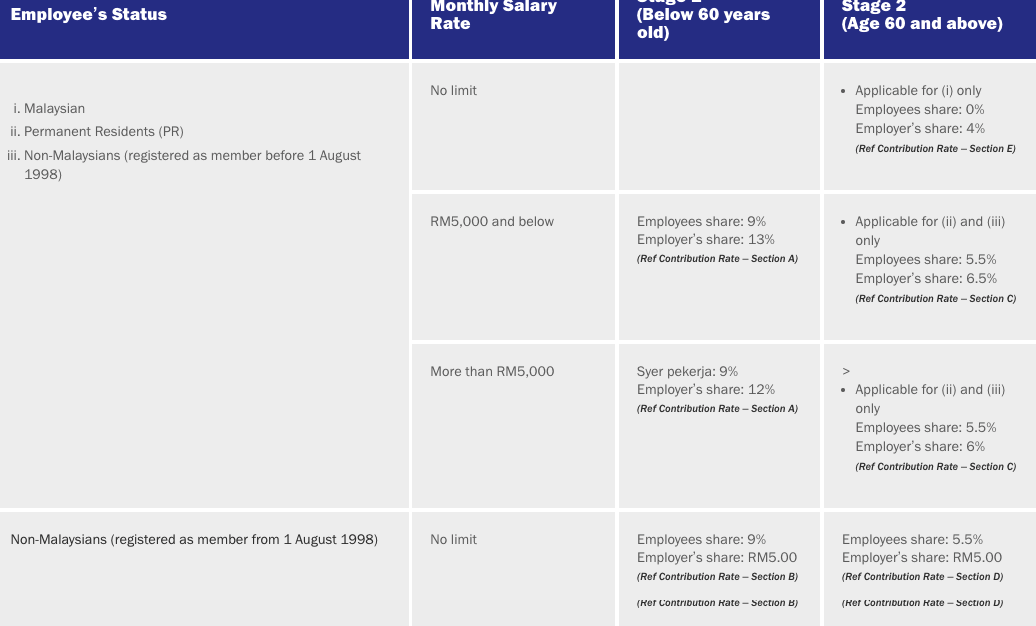

The Employees Provident Fund EPF announces that the minimum Employers share of EPF statutory contribution rate for employees above. The latest contribution rate for employees and employers effective July 2022 salarywage can be referred in theThird Schedule. The rate of monthly contributions specified in this Part shall apply to the following.

EPFO on March 4th 2021 announced the EPF rate of interest at 850 keeping it the same as of the previous year 2019-20. Employees Provident Fund. Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952.

RATE OF MONTHLY CONTRIBUTIONS PART A 1. While computing the interest the PF interest rate applicable every month is 85512 07125. In 2019-18 members of EPFO earned an 865 of.

Employees EPF contribution rate. EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1. Employer Contribution EPS833150001250 Difference2400-12501150 Total Employer PF125011502400.

The minimum employers share of the Employees Provident Fund EPF statutory contribution rate for. Dated 28th february 2019 the contribution shall be calculated on the basis of monthly. Assuming that the service was joined by the.

KUALA LUMPUR Jan 7. EPF - What is employee provident fund contribution rate interest rate how to check epf balance and different ways to withdraw epf money. Last updated at Aug.

The PF interest rate for 2017-2018 is 855. What are the contribution rates for epf. EMPLOYEES PROVIDENT FUND ACT 1991.

Sun Mar 24 2019. So below is the breakup of EPF contribution of a salaried person will look like. January 2019 salarywage up to March.

Employers contribution towards EPS subject to limit of 1250 1250. The rate of monthly contributions specified in this Part. Employers contribution towards EPF 3600 1250 2350.

January 07 2019 1604 pm 08. Let assume the basic salary of a person is INR 20000. Previous employers EPF contribution rate was 6 per month for employees aged 60 and above while employees were required to contribute 55.

If an employees salary below rm 5000 the.

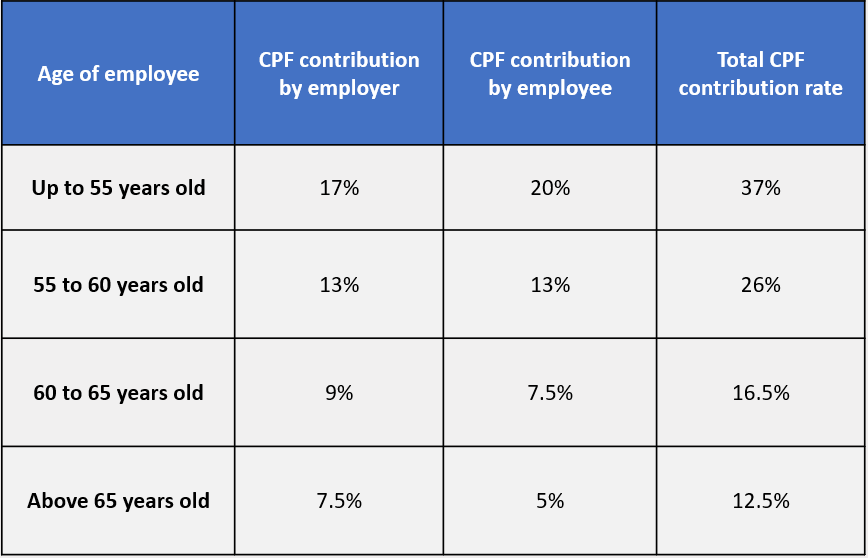

How To Calculate Employer Cpf Contribution Rate In Singapore Links International

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

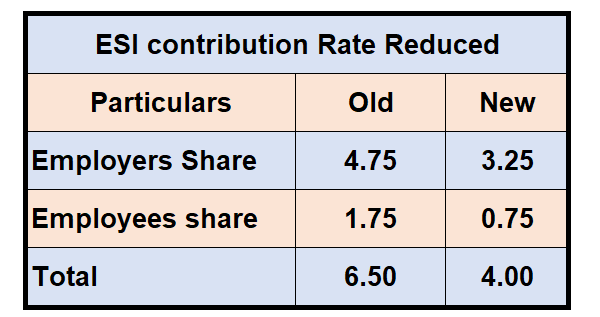

Government Reduces Rate Of Esi Contribution To 4 Hrapp

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf New Employee Minimum Statutory Contribution Rate On Ya2021 Yau Co

What Is The Epf Contribution Rate Table Wisdom Jobs India

20 Kwsp 7 Contribution Rate Png Kwspblogs

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

A Full Guide About China Social Security System Hrone

20 Kwsp 7 Contribution Rate Png Kwspblogs

Esi And Pf Calculation Based On Pay Grade For India Sap Blogs

Complete Guide To Singapore Payroll Taxes Iras Cpf And Other Contributions

Reduction In Epf Contribution Could Pose As A Risk In The Long Run Business Standard News

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

How To Save Capital Gains Tax On Property Sale

How To Calculation Pf Epf Contribution Employee S And Employer Youtube

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Tax Shield Your Retirement Corpus